Are profits from forex trading. I assumed 51.

Currency Trading Tax In Uk Forex Gains Or Binary Options Dns

Currency Trading Tax In Uk Forex Gains Or Binary Options Dns

Once you have a funded trading account and are making trades you may be liable for tax on forex trading profits.

Forex trading uk tax. One of the areas of forex trading that i find novices are somewhat confused about is the tax treatment of gains or losses made from trading forex or futures. Find the answer to this and other tax questions on justanswer. Open a forex trading account with the uks no1 retail provider and use our range of powerful platforms to take advantage of movements in currency prices.

Whether trading stocks forex or derivatives we explain us taxes and tax implications for traders. Whether you are day trading cfds bitcoin stocks futures or forex there is a distinct lack of clarity as to how taxes on losses. Here is a tax guide on forex trading in the uk.

While i am not an expert residents of the uk have the option of opening a spread bet account with their broker which does not attract any tax. Uk trading taxes are a minefield. If you do this regularly and end up clocking up a profit are you tax.

Tax rate information for day trading in the us. Question i am intending to start trading in forex for a living.

Forex H4 Strategy Forex Trading Strategy 10 H4 Bollinger Band

Trading Forex How To Trade Forex City Index Uk

Trading Forex How To Trade Forex City Index Uk

Forex Trading Uk Tax Implications How Currency Traders Can Reduce

Forex Trading Uk Tax Implications How Currency Traders Can Reduce

Why Forex Trading Is Tax Free 19 Jul 2017 Learn To Trade Blog

Why Forex Trading Is Tax Free 19 Jul 2017 Learn To Trade Blog

Currency Trading Tax In Uk Forex Gains Or Binary Options Dns

Currency Trading Tax In Uk Forex Gains Or Binary Options Dns

Demo Forex Trading Account Risk Free Online Fxcm Uk

Demo Forex Trading Account Risk Free Online Fxcm Uk

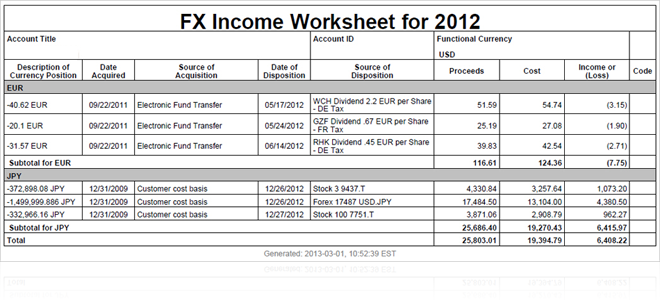

Tax Information And Reporting Fx Pl Interactive Brokers

Tax Information And Reporting Fx Pl Interactive Brokers

Income Tax On Trading Options Error Forbidden

Do You Pay Tax On Binary Options Uk Trading Binary Options In The Uk